operating cash flow ratio importance

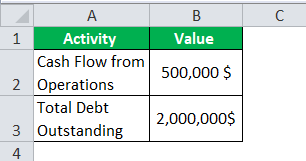

Lets calculate Radhas store by using the indirect method. Operating cash flow indicates.

Cash Flow From Operations Ratio Formula Examples

Cash flow is the money which flows in and out of businesses.

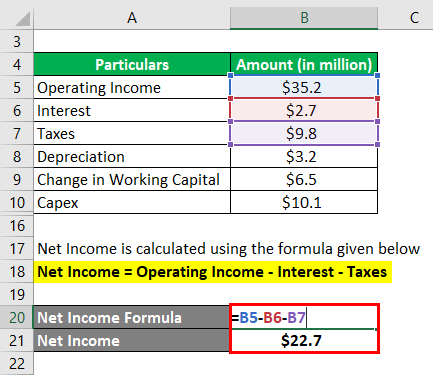

. Operating cash flow OCF is one of the most important numbers in a companys accounts. Operating Cash Flow Net Income - Changes in Assets and Liabilities Non-Cash Expenses. Although there is no one-size-fits-all ideal ratio for every company out there as a general rule the higher the Operating Cash Flow Margin the better.

The formula to calculate the ratio is as follows. Operating Cash Flow - OCF. The operating cash flow ratio provides a clear financial assessment of your companys needs and can help you plan for the health of your business.

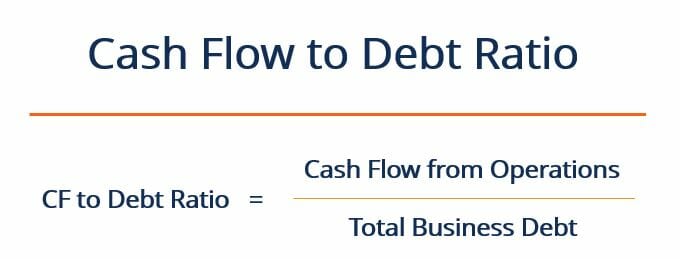

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. It has a few. Operating cash flow ratio This ratio calculates how much cash a business makes as a result of sales.

100000 50000. Operating cash flow is a measure of the amount of cash generated by a companys normal business operations. The different types of.

It reflects the amount of cash that a business produces solely from its core business. Note that operating cash flow is different from operating cash flow ratio. Operating Cash Flow Ratio Operating cash flow.

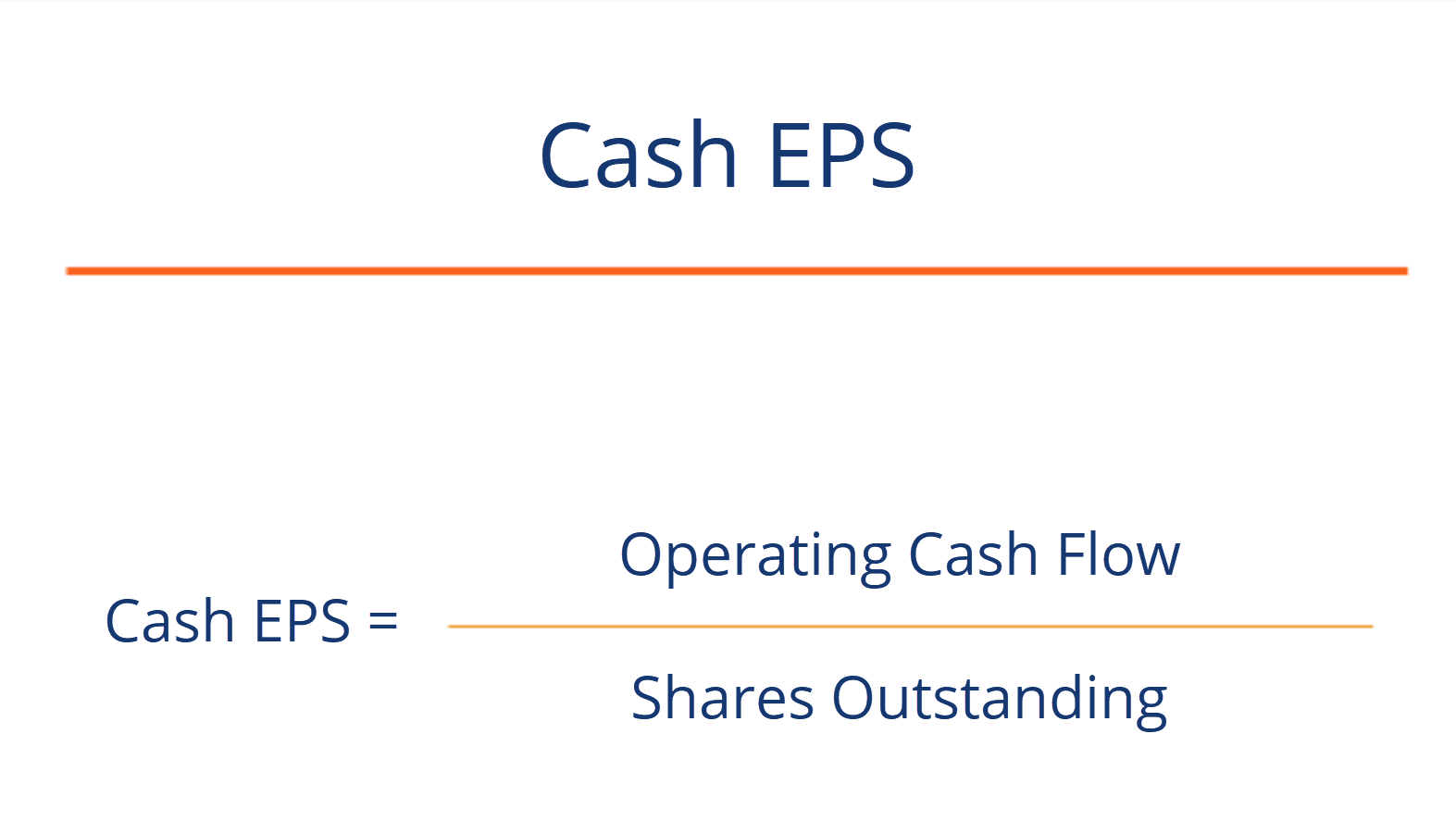

What is the Operating Cash Flow Ratio. This ratio can help gauge a companys liquidity in. The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded.

For starters the operating cash flow ratio shows the overall health of your businesshow much money it has managed to accumulate from its basic activities. If this ratio increases over time thats an. It measures the amount of operating cash flow generated per share of stock.

Operating cash flow or OCF is the money your company earns via daily business activities. A preferred operating cash flow number is greater than one because it. To stay financially solvent you must make enough money through general.

Operating cash flow ratio helps you measure a companys liquidity by determining how capable it is to cover liabilities by the money it is making from its primary operations. Operating cash flow Net cash from operations Current liabilities. Now that a definition has been established its time to look at how to calculate operating cash flow ratio.

The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a companys operations. The operating cash flow ratio operating cash flow ratio is a financial metric that uses cash flows generated from business operations to calculate how readily current liabilities. Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you.

It can be classed as positive or negative indicating the increase or decrease in cash flow at the time. Operating cash flow ratio is used to understand if a company can pay off its liabilities or. According to the current ratio formula current assets are everything that your company has that can be liquidated or converted into cash within a year.

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow Per Share Formula Example How To Calculate

Free Cash Flow Formula Calculator Excel Template

Cash Flow To Debt Ratio Meaning Importance Calculation

Operating Cash Flow Ratio Definition Formula Example

Cash Flow From Operations Ratio Formula Examples

Operating Cash Flow Definition Formula And Examples

Price To Cash Flow Formula Example Calculate P Cf Ratio

Fcf Formula Formula For Free Cash Flow Examples And Guide

Operating Cash Flow Ratio Calculator

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)